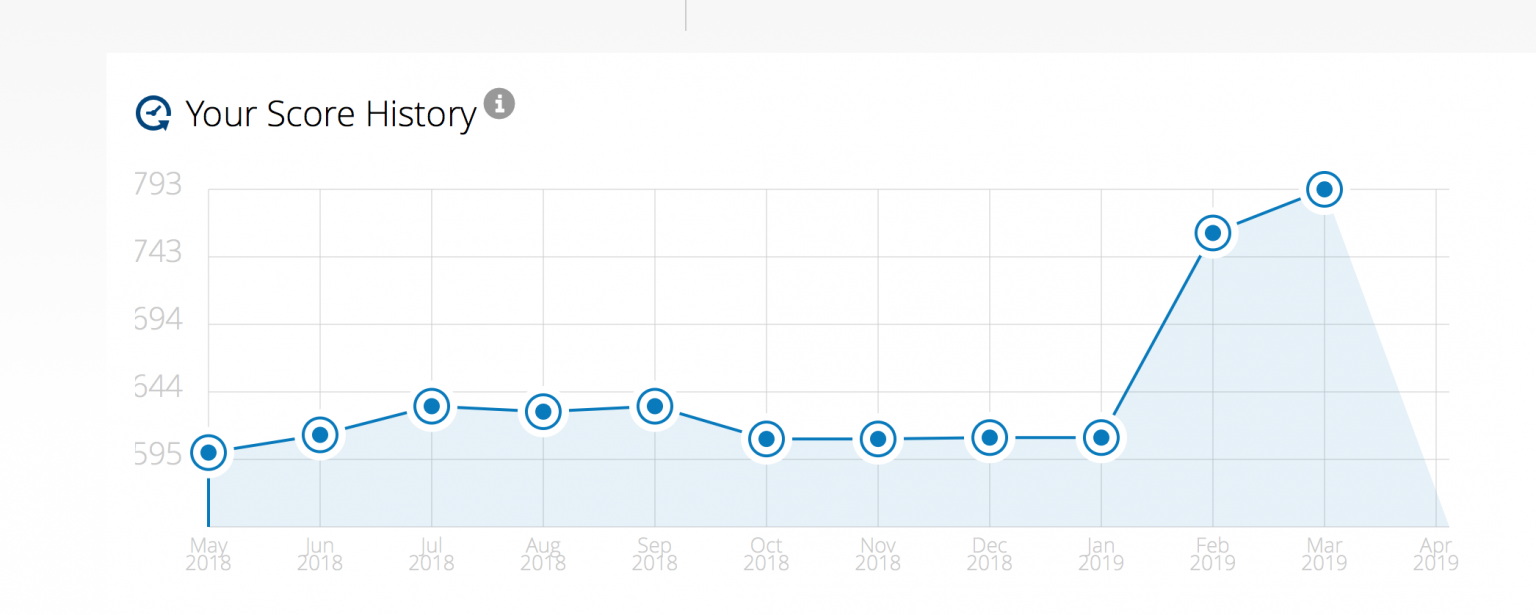

Unique Tips About How To Increase Credit Score In 30 Days

Develop a budget and stick to it.

How to increase credit score in 30 days. Boosting your credit score from fair to very good could result in $16,677 in mortgage savings, accounting for 75% of the total savings,” lendingtree noted. Become an authorized user 4. Taking control of your finances is another fundamental step toward fixing your credit.

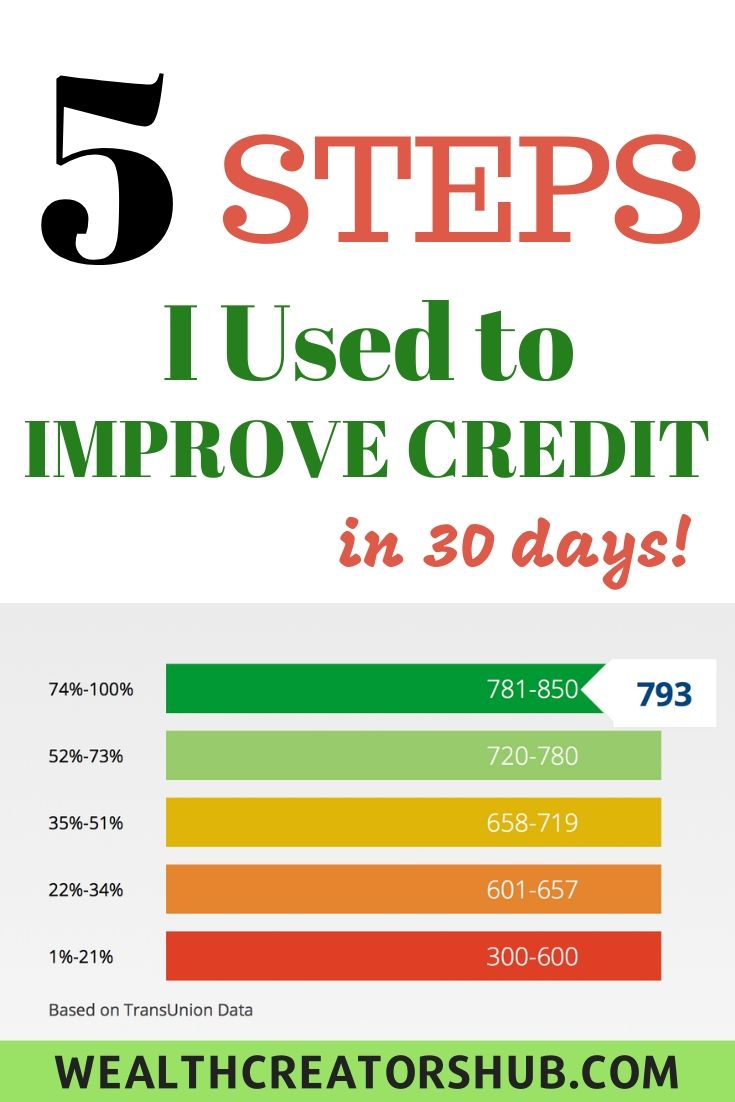

Start by creating a realistic budget that. Checking your credit report once a year helps you ensure lenders analyze your borrowing behavior. Here are the ranges experian defines as poor, fair, good, very good and exceptional.

It can be the key to unlocking great financing and installment loans or the. Ask for a credit limit increase 3. Although there are no super quick fixes to raising a low score, if you dispute errors, pay your bills on time, pay down debt and add positive credit history, you can.

The later the payment, the more it will impact your score. You might not know it, but your. This prevents them from accumulating more debt and allows them.

Lower your credit utilization rate ask for late payment forgiveness dispute inaccurate information on. By implementing these ten strategies with diligence and consistency, you can witness. 7 ways to raise your credit score in 30 days:

The representative should review the. Get a secured credit card Modified on january 11, 2024 your credit score is one of the most critical numbers that follow you.

Removing negative information from your credit report is perhaps the best. Steps you can take to raise your credit score quickly include: Pay off credit card debt 2.

Dispute inaccurate data on your credit reports let’s summarize… 3 real ways to boost your credit score in 30 days focus on utilization. When calling your issuer, tell the customer service representative you’d like to request a credit limit increase on your card.

Introduction improving your credit score can seem like a daunting task. Pay down your revolving credit balances if you have the funds to pay more than your minimum payment each month, you should do so. Fight credit report errors who this helps:

Only late payments over 30 days are reported to the credit bureaus. Lowering your available credit can increase your credit utilization, which, again, is worth 30% of your credit score. If you’re wondering how to improve your credit score in 30 days, paying down your credit cards is often a great place to start.

![7 Tips to Increase Your Credit Score [Infographic]](http://www.trimurty.com/blog/wp-content/uploads/2016/12/Infographic-7-01-1.jpg)

![How to Increase Credit Score Fast [EASY TRICK] YouTube](https://i.ytimg.com/vi/L_XkMBJbjwA/maxresdefault.jpg)