Nice Tips About How To Write Personal Loan Contract

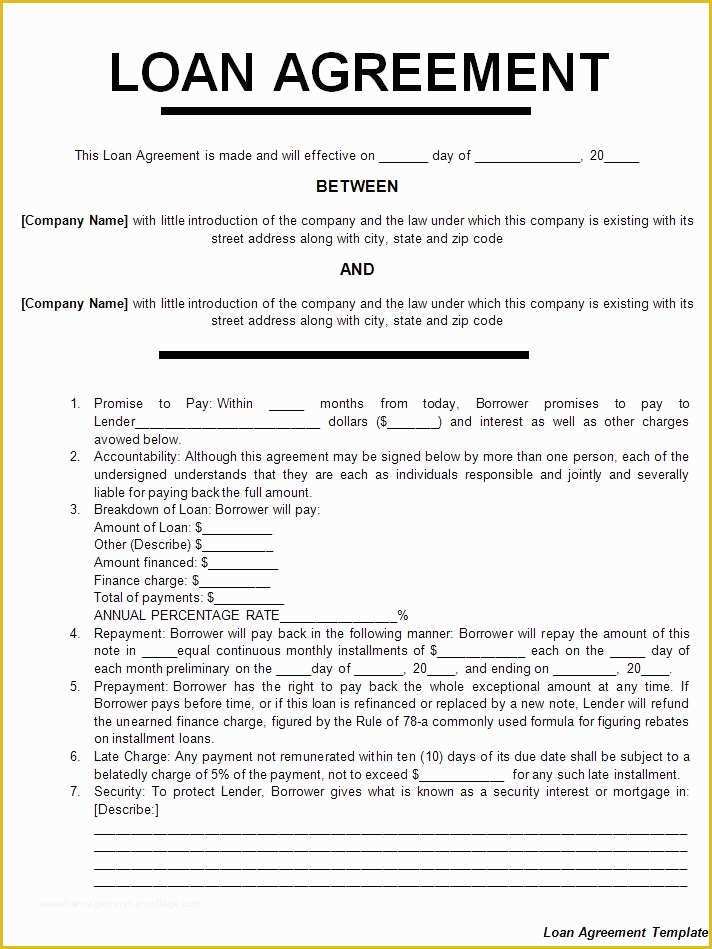

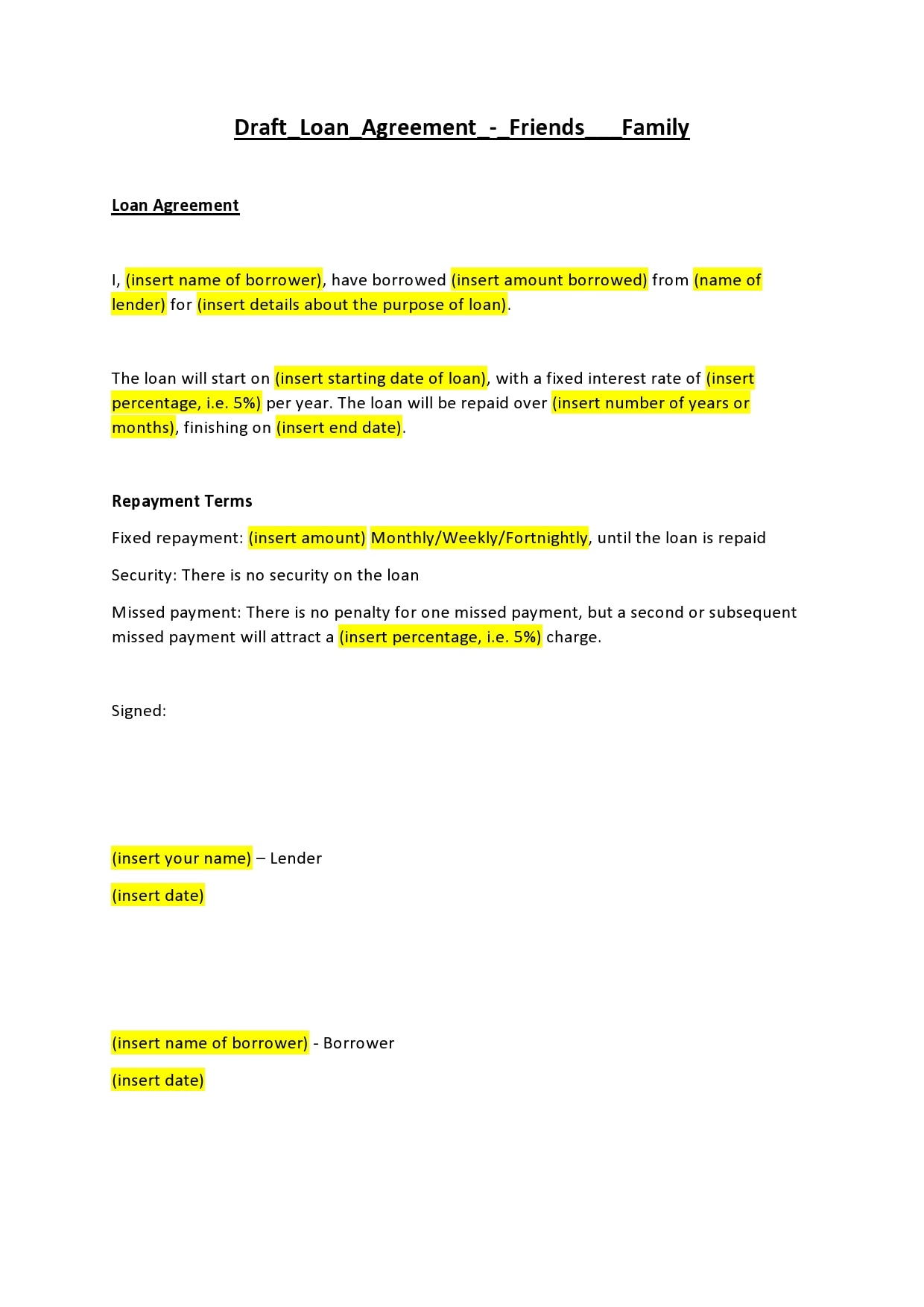

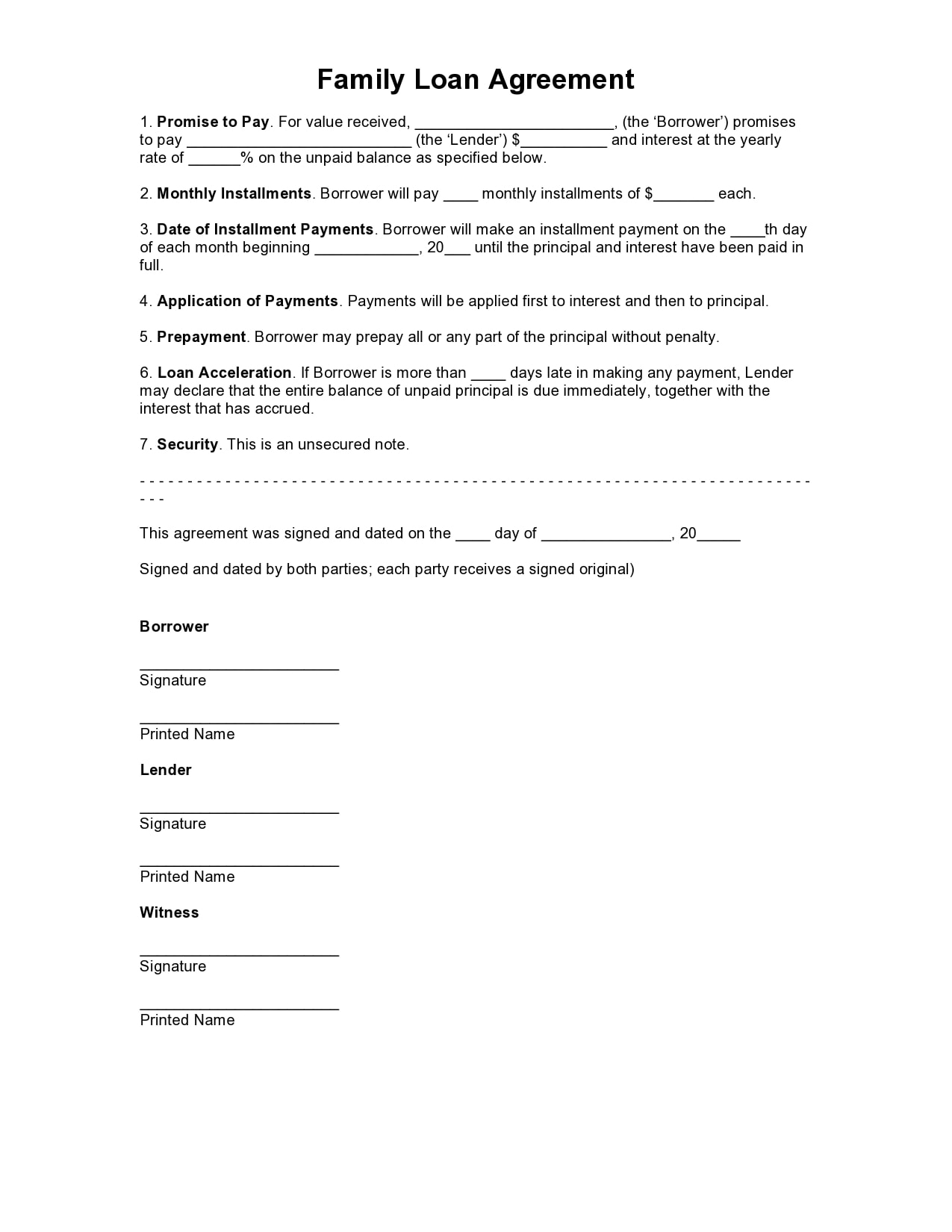

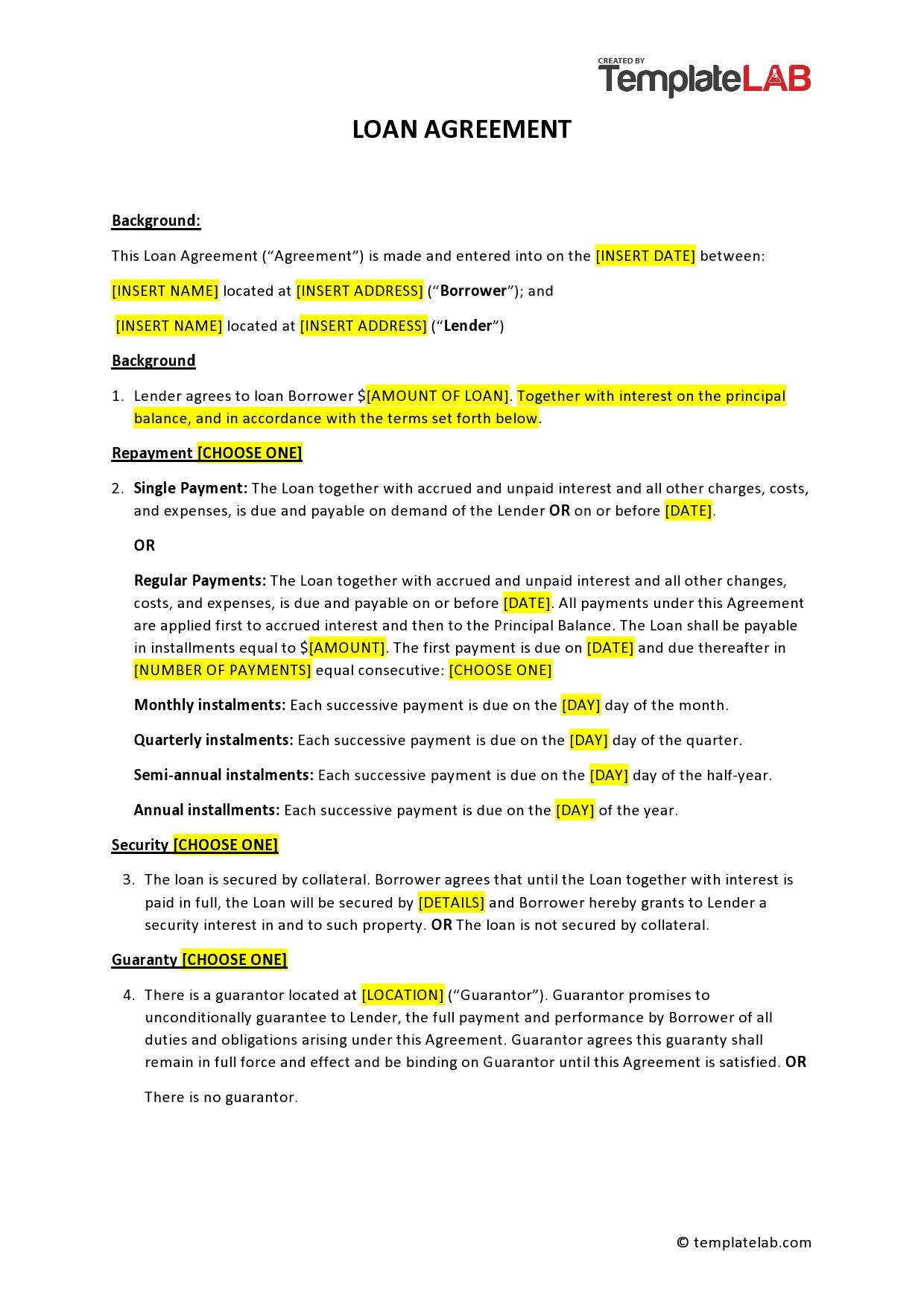

Either party wants a binding legal document that officially lays out all the terms of the loan, including repayment, penalties, interest and more.

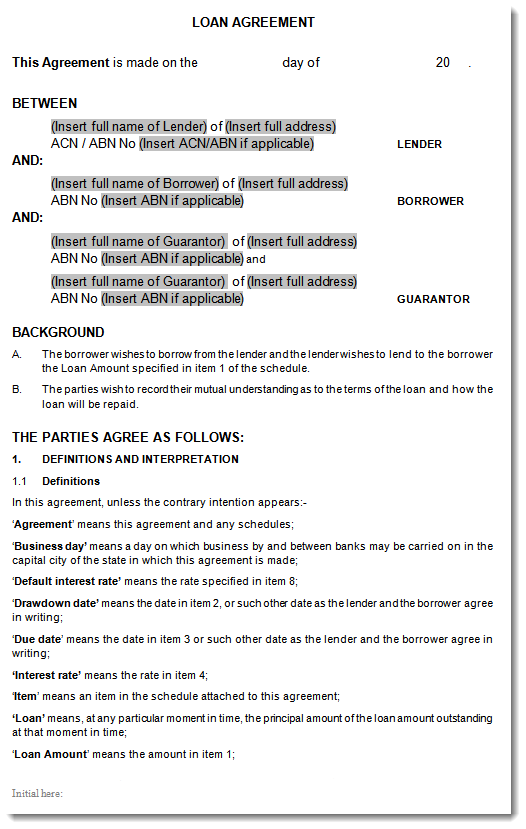

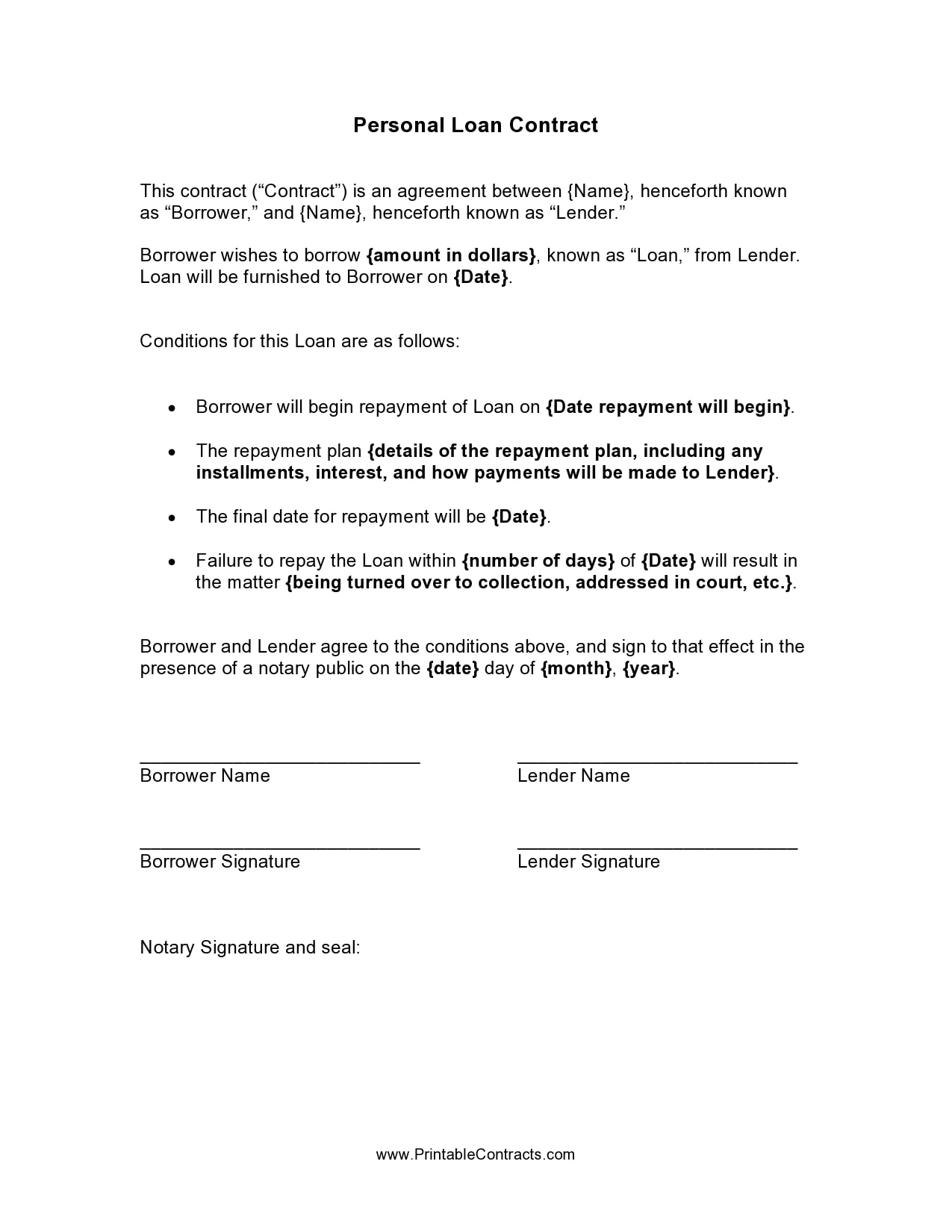

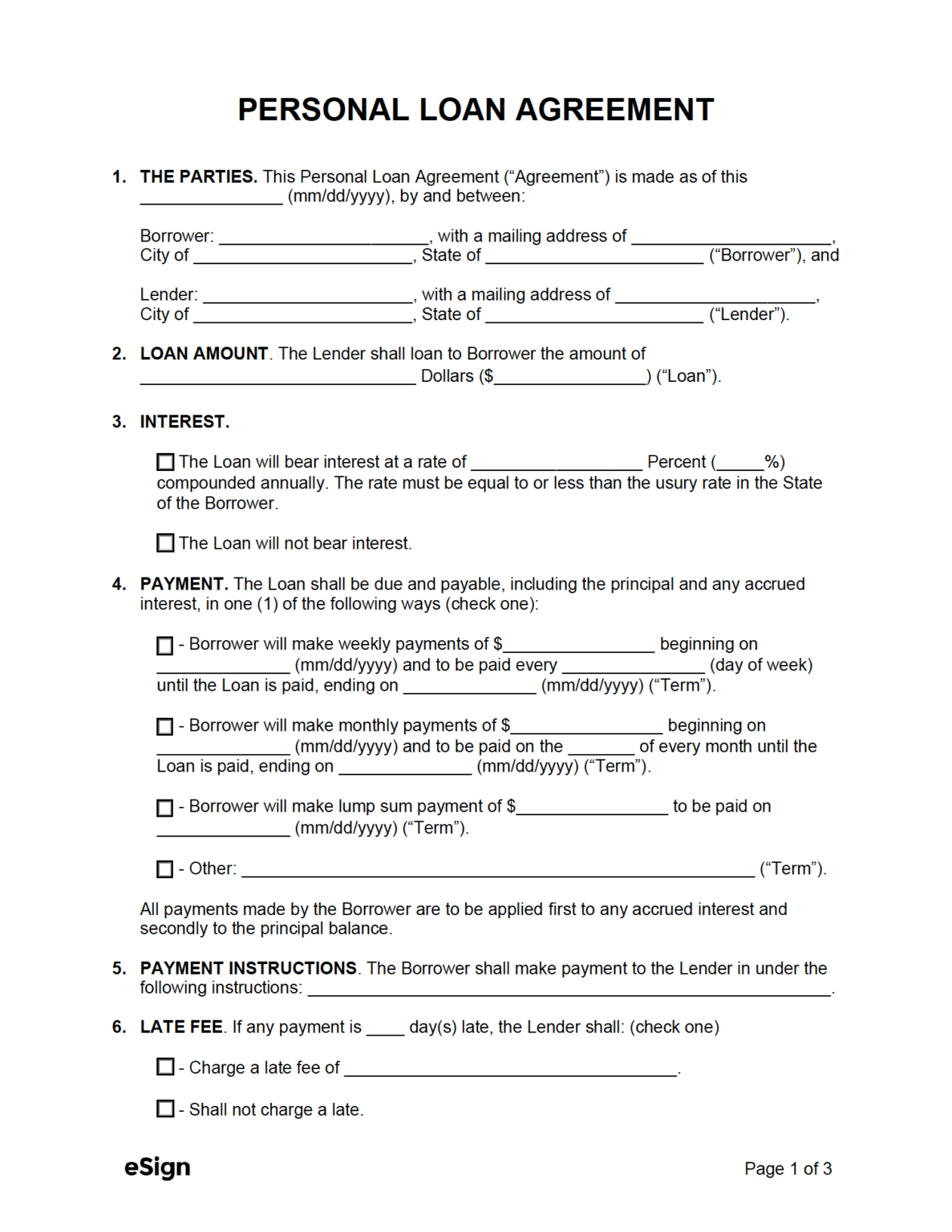

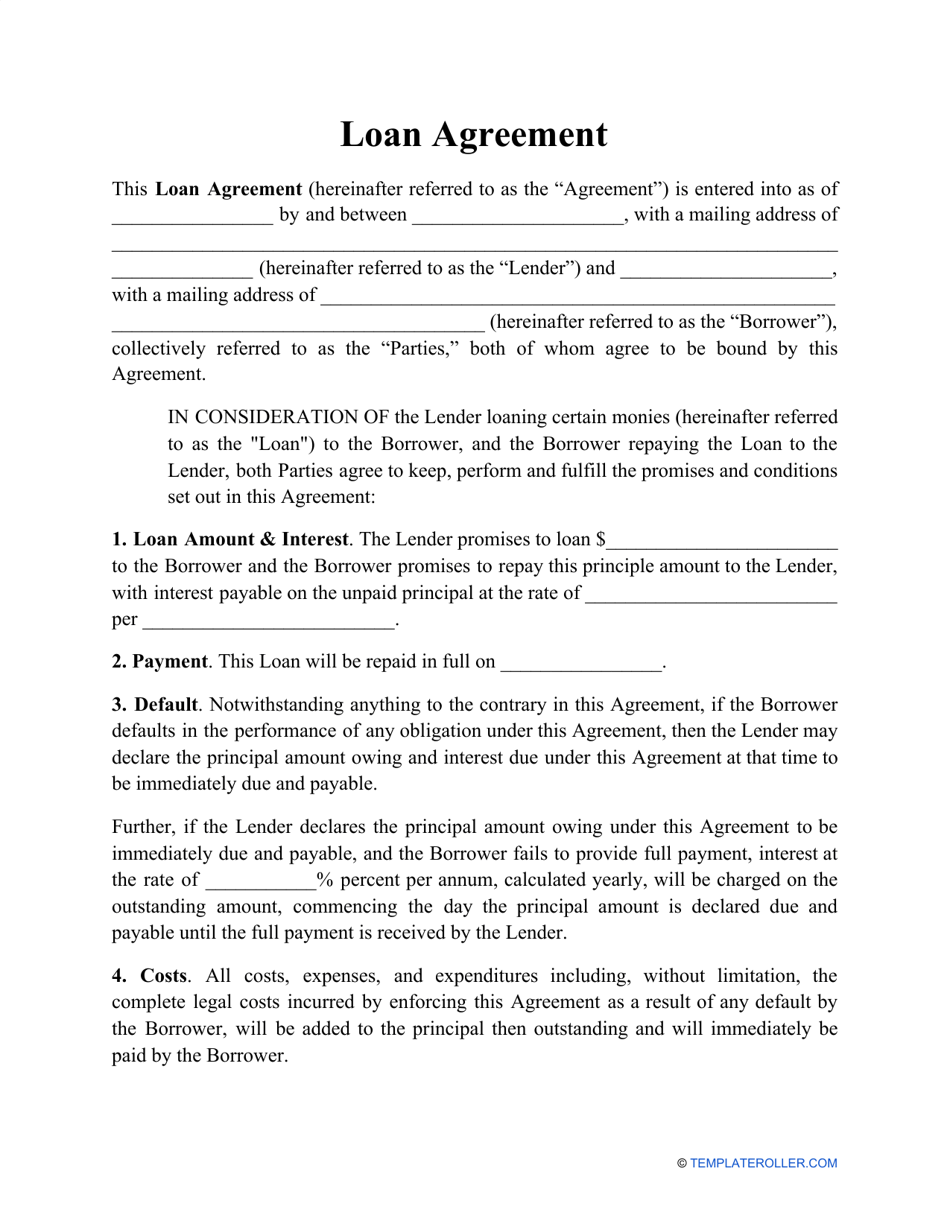

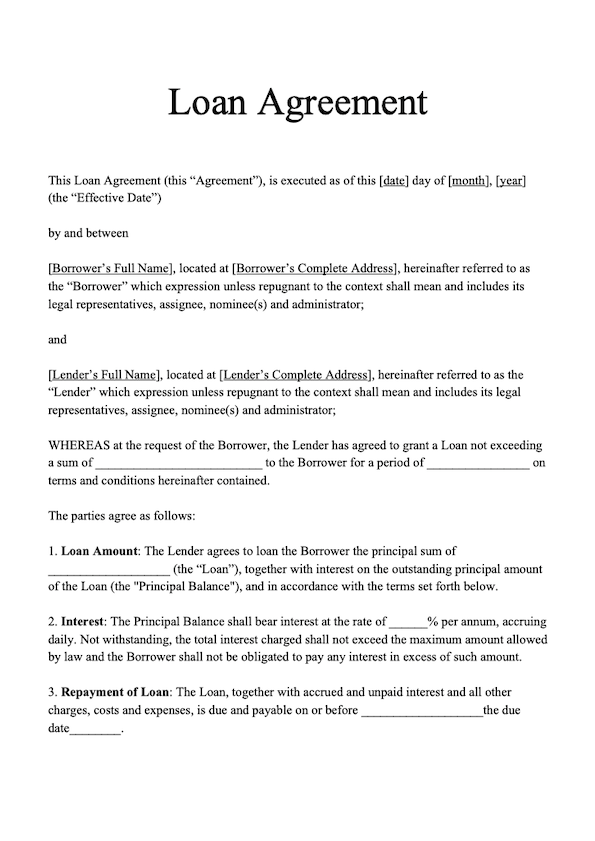

How to write personal loan contract. A loan agreement is a written agreement between a lender that lends money to a borrower in exchange for. This personal loan agreement (the “agreement”) is made as of this [mm/dd/yyyy], by and between [borrower name], with a mailing address of. All states | 6 types.

Personal loan agreement template. A loan agreement or loan contract is a written agreement that specifies all the details of a personal or business loan, including the amount of money or the assets being lent, the. The amount of money being borrowed is an important.

This should include the names of the borrower and lender, the amount of money being borrowed, the interest rate (if any), and the. A loan agreement typically includes the following key elements: Get help with a loan contract.

No, notarizing a personal loan agreement isn't usually required. Fill forms in a few steps. Can i write my own loan contract?

However, it can help to have an official record of the contract to encourage both parties to take the. To draft a loan agreement, you should include the following: / loan agreement.

The addresses and contact information of all parties involved. When to use a personal loan. The loan agreement specifies the amount of money that is being borrowed by the borrower from.

But if you’re lending a large amount of money, such as a personal loan to. Your address and other contact information may also be in the loan agreement. What’s typically included in loan contracts?

Most of us have written an informal iou before when we lend money to someone. A personal loan agreement solidifies the terms,. Personal information about the lender and borrower, such as names, addresses and.

![40+ Free Loan Agreement Templates [Word & PDF] ᐅ TemplateLab](http://templatelab.com/wp-content/uploads/2017/04/loan-agreement-template-04.jpg)

![40+ Free Loan Agreement Templates [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2017/04/loan-agreement-template-20.jpg)

![40+ Free Loan Agreement Templates [Word & PDF] ᐅ TemplateLab](http://templatelab.com/wp-content/uploads/2017/04/loan-agreement-template-08.jpg)